Crypto derivatives trading offers massive potential for profits – which is why it’s so hyped. But it comes with equally significant risks that many of us overlook.

The volatility that makes the crypto market engaging can also wipe out our capital in minutes if we’re not careful.

In fact, studies show that over 90% of crypto derivatives traders lose money, and poor risk management is the primary reason.

The difference between traders who thrive and those who don’t often boils down to one factor – how well they manage risk.

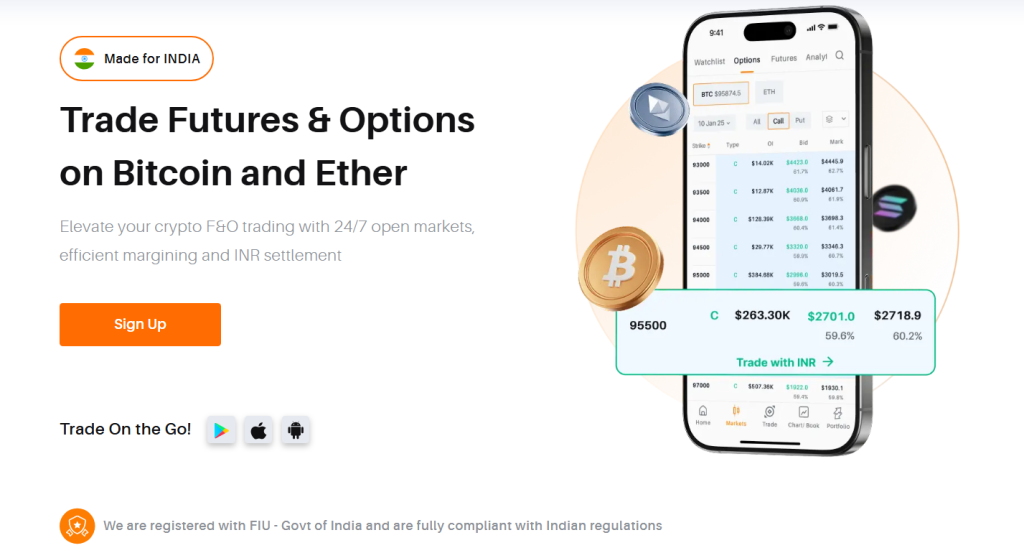

Here’s where Delta Exchange, a leading crypto trading platform, comes in. It offers tools and features specifically designed to help you protect your capital and trade with more discipline.

Top Ways to Minimize Risks in Crypto Derivatives Trading

Let’s explore the top five ways in which Delta Exchange helps you navigate futures and options trading.

- Demo Account: Practice Without the Pressure

One of the biggest mistakes new traders make is jumping into crypto derivatives with real money before they fully understand how these instruments work.

Delta Exchange’s demo account solves this problem.

What you can do with the demo account:

- Test futures and options strategies without risking real money.

- Experiment with basket orders and multi-leg positions.

- Practice algo trading through APIs before going live.

- Build confidence and understand how crypto derivatives behave under different market conditions.

- Payoff Charts: Visualize Risk Before You Trade

In crypto derivatives trading, understanding your potential profit and loss before entering a position is crucial. A small swing in BTC or ETH prices can impact your contract in ways that aren’t immediately obvious, especially when dealing with options or leveraged futures.

Payoff charts give you this clarity. Before you execute any trade, you can see the potential profit and loss details and breakeven points under different market scenarios. The visual representation transforms risk management in crypto from guesswork into informed decision-making.

- Basket Orders and Diversification: Don’t Put All Eggs in One Basket

Overexposure to a single position is one of the fastest ways to blow up your account in crypto derivatives. Here are a few benefits of basket orders:

- Execute multiple positions simultaneously to build complex strategies.

- Spread risk across futures, options, and trackers instead of one concentrated bet.

- Create balanced setups that protect against extreme volatility.

- Reduce the impact of a single trade gone wrong on your overall portfolio.

With Delta’s basket orders, you can combine multiple instruments to create a portfolio that’s more resilient to market swings. This approach to risk management helps ensure that a single unexpected price movement doesn’t wipe out your entire account.

- Algo Trading Bots: Eliminate Impulse from Trading

Delta Exchange’s algo trading bots do away with emotional bias by automating your trades based on preset strategies. Once you define your risk parameters and trading rules, the bots execute trades consistently without emotional interference.

Here are the advantages of algo bots for efficient risk management in crypto:

- Execute trades based on logic, not emotion or market hype.

- Apply stop-losses and take-profits automatically without hesitation.

- Trade 24/7 even when you’re away from your screen.

- Maintain consistent risk management across all positions.

Whether you’re a day trader managing multiple crypto derivatives positions or a swing trader who can’t monitor markets around the clock, algo bots give you the automation needed to stay disciplined.

- Advanced Risk Controls: Stop-Loss, Leverage Management, and More

Delta Exchange goes beyond basic features by offering institutional-grade risk controls that help you manage exposure at every level. These tools ensure you’re never caught off-guard by sudden market moves in crypto derivatives.

Check out the key risk management features on Delta Exchange:

- Customizable stop-loss orders: Automatically exit positions when prices hit predetermined levels, preventing small losses from becoming catastrophic.

- Flexible leverage settings: Full control over leverage levels up to 200x, allowing you to adjust based on market conditions and risk tolerance.

- Real-time position monitoring: Track all your open positions and exposure levels instantly.

- High liquidity: Algorithms ensure smooth execution without slippage.

The Bottomline

Risk management in crypto derivatives is foundational for sustainable trading. Delta Exchange understands this and has built features designed to protect your capital at every step.

The crypto market will always carry risk, but with the right tools and practices, you can tilt the odds in your favor. Delta Exchange offers you practical ways to manage risks effectively and trade with confidence.

To start crypto futures and options trading, visit www.delta.exchange or join the community on X for all the latest updates.

Disclaimer: Investing in cryptocurrency involves several inherent risks and high market volatility. Kindly research before investing.