Librium is what happens when a never-before-seen tokenomic structure is paired with mining rewards indefinitely, increasing the value of the token as miners are equipped to grow passive income rewards for holders.

The redistribution of rewards through the utilization of cryptocurrency miners creates reward structures encouraging investors to increase their holdings and removes the necessary contract interaction to sell tokens to pay out rewards that other tokens implement, which is one of the primary reasons why existing reward tokens fail miserably.

Abstract

Selling to existing customers costs brands less than acquiring new ones, which is a leading reason why more than 90% of companies have some type of customer loyalty program. Rewards points are one of the most effective methods for increasing both customer loyalty and revenue. For example, Starbucks Rewards is one of the most successful rewards programs around. It has more than 19 million members, with the redemption of points responsible for almost 50% of company revenue. Starbucks utilizes Starbucks Rewards to align with its business goals in a way that adds value and increases customer engagement through a fun, gamified approach.

While it’s undeniable that loyalty and rewards programs are an essential component of the consumer-brand relationship, they have their limitations. Complexity, lack of liquidity, and interoperability are some of the main roadblocks to expanding loyalty and rewards programs to more customers. The lack of clarity around program rules leads to a lot of value left on the table.

Implementing real hardware infrastructure, position and percentage-based tokenomics, multiple rewards structures, passive income from miners, and whale reflections, Librium Tech is pushing forward with a token that has the potential to always rise in value, Librium Tech will be paired with BUSD and then re-paired with BNB to take advantage of the market crashes.

Why Librium?

The team behind Librium is set out to fix common pitfalls of other rewards based tokens like having to pay network fees for claiming you rewards and token prices crashing after the whales dump their holdings, Librium offers unique tokenomics paired with passive income rewards through mining, not only that but as the miners are added, the token value increases indefinitely thus creating a heavy buying pressure to encourage investors to increases their holdings for higher rewards. Using a gamified approach Librium creates a competition between the top holders that further the upward price action.

Librium is fair to all:

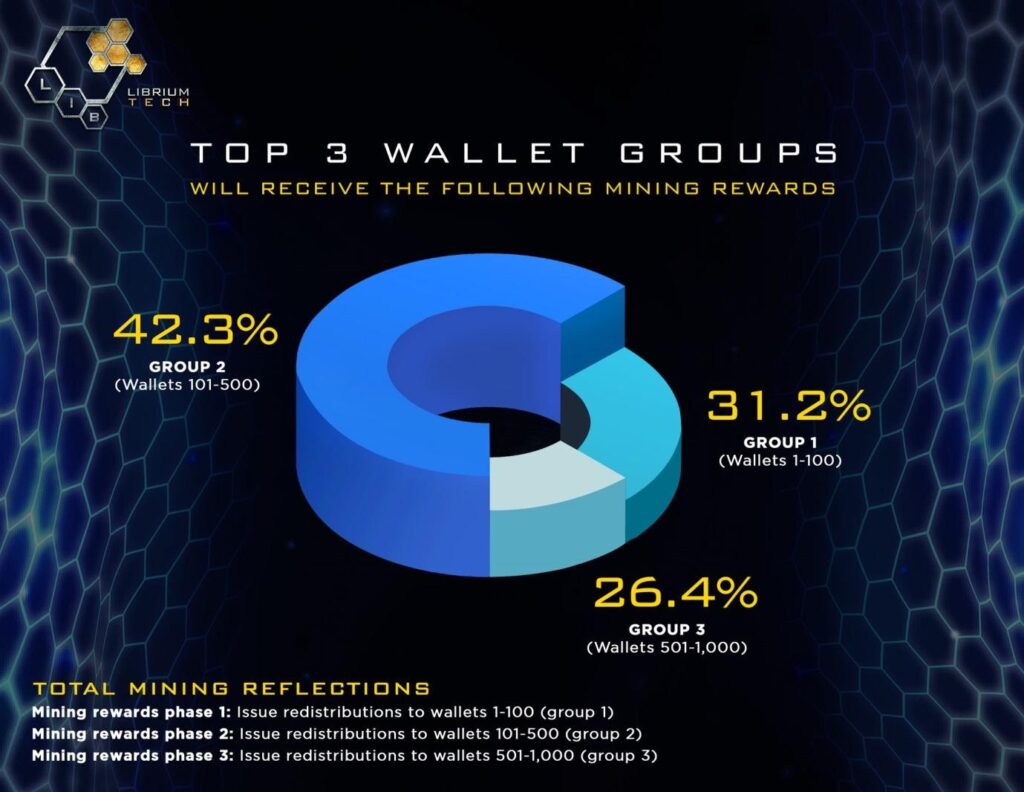

The passive income rewards for the top 1000 holders are broken into 3 groups, reflections are distributed based on the percentage of tokens held by individuals, with 2% of Librium token reflections provided to all the holders.

The top 1000 holders share the rewards in the following manner:

There are 3 groups as follows

Group 1 has top 100 wallets receives 31.2 percent of the total mining rewards, followed by Group 2 with wallets ranging from 101 to 500 receiving 42.3 percent of the total mining rewards, and the last group, Group 3 which has wallets ranging from 501 to 1000, receiving 26.4 percent of total mining rewards.

These mining rewards incentivize the top holders to hold or improve their position in the overall wallet rankings as just by moving up from group 3 to group 2 effectively doubles the number of mining rewards a user may receive, moreover moving up from group 2 to group 1 nearly triples these mining rewards.

An investor in group 1 receives 0.312 percent of the total mining rewards pool, in group 2 receives 0.084 percent of the total mining rewards pool, and an investor in group 3 receives 0.052 percent of the total mining rewards, considering these numbers, an investor can easily 5x their rewards just by moving up to group 1 from group 3.

To get an impression of the potential earnings for the top 100 wallets in group 1, here is a breakdown that shows Librium can easily generate a monthly passive income ranging from $600 to just under $18,000 with a moderate daily volume of $250,000!

Tokenomics:

Current tokenomics suggest that there is a tax of 12 percent imposed on every transaction, which further breaks down into 4 percent being sent to the mining wallet, which will be used to buy and maintain the miners to yield mining rewards. 2 percent will go to all the holders in the form of native reflections, 1 percent each is allocated for whale reflections, staking reflections, marketing wallet, dev wallet, liquidity providers, liquidity pool, and last but not the least Buy-Backs.

Just to get a glimpse of how effective these tokenomics can be, here is an overview of how these tokenomics will perform if Librium was averaging at $500,000 daily volume, which would result in $5,000 worth of rewards being generated every day, the most impressive part is how it plays into the 1 percent whale reflections that are received by the top 30 wallets

During the week, these daily $5,000 will be distributed among the top 30 wallets, every day the bottom 5 wallets will be removed thus reducing the number of wallets receiving the whale reflections, which in turn increases the value of the individual rewards received by the surviving holder in the following bracket.

The holders that make up the rest of the top 30 also receive handsome daily sums, which over the course of a week can really add up:

- holders 26–30: $ 166

- holders 21–25: $ 366

- holders 16–20: $ 616

- holders 11–15: $ 949

- holders 6–10: $ 1,449

- holders 2–5: $ 2,449

- holder 1: $ 7,449

The team behind Librium shares a vision to create a simple concept behind their project to generate passive income for their investors. Librium is a project that the majority of the investors and present community members believe in, not only that Librium is also compliant with all the cryptocurrency guidelines laid out by the SEC and strongly believes that these regulations are there to protect the investor’s hard-earned money.

Social Links:

Website: https://www.librium.tech/index.php

Telegram: https://t.me/LibriumTechOfficial

Twitter: https://twitter.com/LibriumTech

Media Contact:

Librium

info@librium.tech

PR Contact:

Dave Ruiz

Telegram: https://telegram.me/cryptokidfinance

Dave@CryptoKidFinance.com