YEREVAN (CoinChapter.com) — Dubai-based Allo tokenization platform has secured a $100 million Bitcoin-backed credit facility, according to a December 19 announcement. The credit line was funded by a consortium of lenders, including Greengage and a “long-standing” financial institution from the United States.

Real-World Asset Tokenization Expands

Allo specializes in real-world asset tokenization and Bitcoin-backed lending, providing opportunities for users to tokenize assets like real estate and commodities. Before securing this credit facility, Allo participated in the Binance Labs accelerator program, where it raised $750,000 in investment. In addition, the platform has raised $2 million in seed funding from notable investors, including NGC, Gate Labs, and Morningstar Ventures.

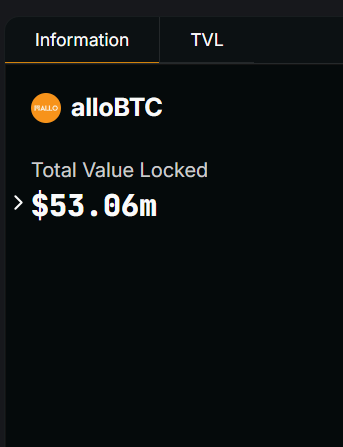

The company has over 544 BTC staked through the Babylon protocol. These staked tokens are used to mint the alloBTC token, which is currently valued at $53 million based on DefiLlama data. Allo has facilitated $2.2 billion worth of tokenized assets on the BNB Chain, further illustrating its role in advancing real-world asset tokenization.

Tokenized Assets See Rapid Growth

The market for tokenized assets has grown significantly in 2024, driven by increased institutional adoption. Data from RWA.xyz shows that the total value of tokenized assets has risen from $8.3 billion in January to nearly $13.9 billion by December.

Private credit leads this growing market, followed by U.S. Treasury bonds, commodities, and institutional funds. Tokenization allows assets to be digitized, making them more accessible to investors and enabling faster trading and ownership transfers.

Institutional Interest in Tokenization

Institutional players continue to invest in real-world asset tokenization. On December 19, the Plume Network announced a $20 million funding round to enhance its tokenized asset ecosystem. Earlier this year, Securitize secured $47 million in funding, led by BlackRock, to develop platforms for digitizing traditional assets.

These developments align with the predictions by McKinsey, which forecasts the tokenization market to reach $2 trillion by 2030. This growth reflects the increasing demand for blockchain solutions that link traditional financial systems with digital asset platforms.