Key Takeaways:

- The latest BTC price dip made whales capitalize over 34%.

- The overall market players realized a 7% profit.

- Daily miner outflows reached a high point.

- CryptoQuant argues that Bitcoin’s recent rise is limited.

YEREVAN (CoinChapter.com) — Bitcoin (BTC) price has rallied over 60% so far in 2023, crossing over its psychological resistance of $30,000 at one point in time. As of May 22, the price has dropped below $27,000.

Can the Bitcoin price rebound to $30,000 once again? Let’s dwell with the help of three on-chain indicators.

#1 Bitcoin Miners and Whales are Cashing Out

Bitcoin miners and whales (entities that hold more than 1,000 BTC) have been dumping their positions in recent months, according to the data analytics platform CryptoQuant.

The analysis takes cues from CryptoQuant’s Exchange Whale Ratio, meaning “the top 10 inflows to the total inflows of the exchange.” Notably, a higher whale ratio shows rich investors are depositing higher amounts of BTC across exchanges — and vice versa.

On May 7, the Bitcoin Exchange Whale Ratio reached 0.81, the highest since 2019, with CryptoQuant analysts stating:

“Bitcoin transactions by these whales escalated to fairly high levels, with transfers involving more than 40% of the coins. Simultaneously, daily miner wallet outflows reached near-record highs, contributing to the selling pressure during this adjustment period.”

Investors typically transfer their Bitcoin to exchanges when they wish to trade them for other assets. As a result, many analysts treat the inflows as a sign of imminent selloffs.

For instance, the duration of the recent BTC price dip coincided with Long-Term Holders (LTHs) — entities that have held Bitcoin for more than 155 days — capitalizing and earning 34% profits, according to CryptoQuant.

Meanwhile, other market players psychologically followed suit and realized profits that amounted to 7% on average. Overall, the selling pressure in the Bitcoin market sustains, even though short-term holders attempting to keep the price above the $26,500 support level.

#2 US Bitcoin Investors Exodus

US agencies have stirred the crypto market with stricter regulators, starting with the lawsuit against Ripple and following that with the ban on issuing Binance USD stablecoins, etc. As a result, institutional investors have started moving their funds outside the country, per CryptoQuant data.

In detail, the platform’s US to The Rest Reserve Ratio, which reflects “US entities (exchanges, banks, funds) [Bitcoin] supply divided by the rest,” has declined in recent months, suggesting that they have moved their capital to global centralized and decentralized exchanges.

US’s contribution to the Bitcoin market is huge, given Americans are the top BTC users worldwide, holding about 47% of the existing supply. In other words, BTC capital flowing out of the US is not good news for the bulls.

#3 Stablecoin Supply Wipeout

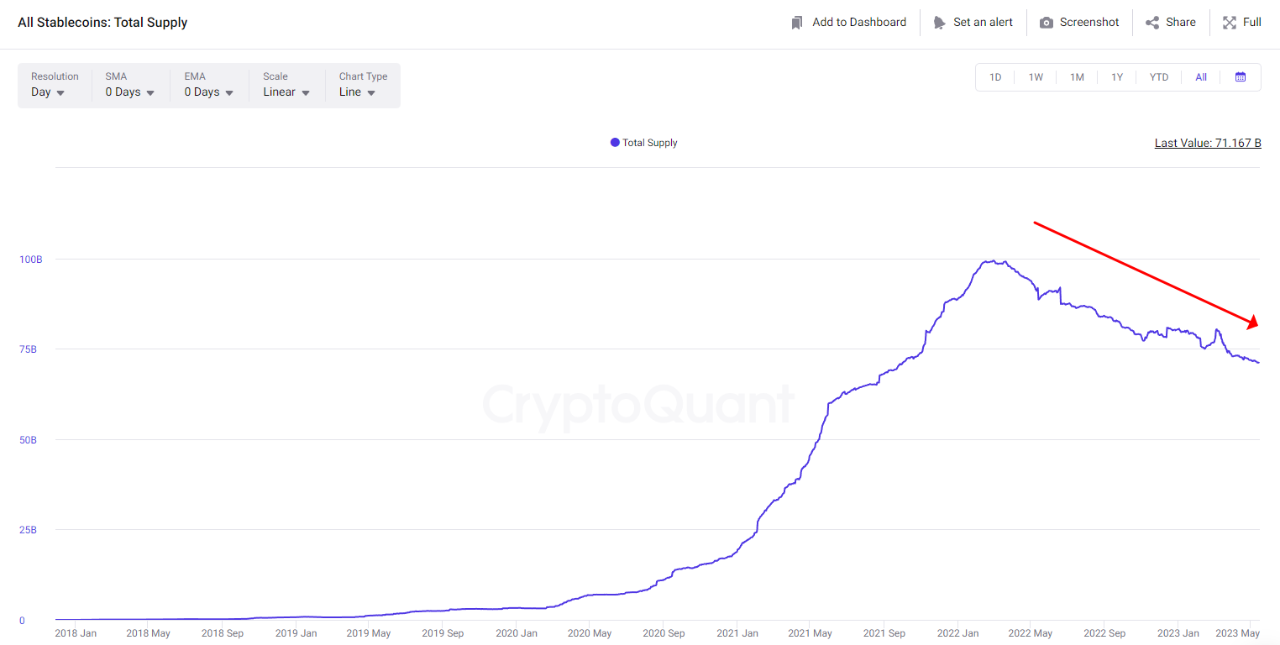

The demand for stablecoins has declined since February 2022 — the supply has dropped $99 billion to $71.1 billion now. That coincides with the dip in Bitcoin prices, which dropped 50% in the same timeframe.

Traders buy stablecoins to use as remittances or purchasing assets, including Bitcoin. So, a dwindling stablecoin supply across exchanges points to a lesser demand for BTC and other cryptocurrencies — and vice versa.

As a result, Bitcoin treads under selling pressure despite rising 60% in 2023.

The post 3 Reasons Why Bitcoin Price May Not Retest $30K in 2023 appeared first on CoinChapter.